Top 10 News About Gst in Malaysia

Many domestically consumed items such as fresh. An Ugly Truth or A Beautiful Lie.

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Additional penalty of 10 on the amount.

. For example in the previous 6 Service Tax regime when you buy a cup of coffee from. On April 01 2015 goods and services tax GST was introduced in AustraliaAll transactions after this affective date are to follow GST norms. Penalty of 5 on the amount of GST due.

An Introduction to Malaysian GST. FMT - A total of RM78 billion in goods and services tax GST refunds is still owed by the Customs Department to companies as of February the Federation of Malaysian Manufacturers FMM. This section will explain to you about requirements with regard to registration for.

Dapatkan Aplikasi Mobil GST di Google Playstore Secara Percuma. The new Prime Minister of Malaysia has committed to withdrawing the 6 Goods and Services Tax setting it at zero from 1 June 2018. 112 Types and rates of GST Three categories of GST will be in use in Malaysia with effect from 1st April 2015.

Malaysias GST went from 6 in May 2018 Mahathirs election promise to zero in June. Malaysia scraps GST June 2018. With a target to close all GST audit-related activity by the end of 2019 its unlikely that all 480000 GST registrants will be audited.

Aplikasi Mobil dan Perkhidmatan MySMS MyUSSD. But the launch was postponed due to avid criticism and the tax finally came into effect on 1 st April 2015. The Goods and Services Tax GST was first planned to be introduced in the 3 rd quarter of 2011 by the government of Malaysia.

The magazine reaches out to a target reader base in the region of 100000. Each differs primarily in the rates and the method of. Top 10 of Malaysia is a magazine that seeks to acknowledge the achievements and accolades gained by Malaysian organizations and individuals and share it with our readers.

It will replace the 105 services and goods tax. PM Mahathir Mohamad has promised to withdraw the consumption tax which was only. I GST payment made between day 1 - 30.

Goods and Services Tax GST Malaysia will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 per cent. How does GST work in Malaysia. Iii GST payment made between day 61 - 90.

Ii GST payment made between day 31 - 60. May 15 2018 Richard Asquith. In the current tax regime the 10 Sales Tax on manufacturing and imports and 6 Service Tax on the FB and professional services industry is collected by one party usually the seller and passed on to the tax authorities.

Klik Sini Untuk Tatacara Penggunaan MySMS dan MyUSSD. It can be used as well to reverse calculate Goods and Services tax calculator. Supplies not made in Malaysia are considered to be outside the scope of GST.

GST is to be charged on a taxable supply of goods or services where the supply is made in Malaysia. The Service Tax was governed by the Service Tax Act 1975 and this was also a federal consumption tax. Malaysia experienced a big decline in inflation after it abolished the gross sales tax GST while the Philippines experienced a big increase in inflation after the Tax Reform for Acceleration and Inclusion TRAIN law.

Malaysia if the provider of the services belongs in Malaysia. GST rates are promised at 4 out of the normal 10 or 5 charged in restaurants. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

Page 2 of 78 earlier stage can always be written off by the businesses at the later stage of the supply chain. The hope and purpose of GST is to replace the sales and service. The existing standard rate for GST effective from 1 April 2015 is 6.

REGISTRATION FOR GST 17. Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015. GST in instances where no criminal proceedings are commenced by Customs.

Last Updated. This means taxes are lower now Consumers need not pay more for one area but its divided into many other source of tax payments. Malaysias recent addition of a Goods and Service Tax GST which was passed by the government during the third quarter of 2011 but delayed until April 2016 has been the cause of much confusion within ASEANs second most developed economy.

These new prices will come into effect starting 1 June 2018 until further notice. GST News KPMG. How ready is your business towards transitioning to a new GST.

Welcome to GST Portal 2012. Malaysias GST was administered by The Royal. Check todays top 10 news stories headline news breaking news latest news politics news sports news entertainment news and business news on Times of India.

IT could take up to two years before businesses are able to. Malaysians may need 2 years to adapt GST TheStar Online 1052014. When was GST introduced in Malaysia.

Implementation will not occur until middle to late 2011 or 2012. The primary objective behind the new and improved GST tax system in Malaysia was to replace the existing Sales Tax and. Before April 1 2015 there was no value-added tax or goods and services tax implemented in Malaysia.

It will be replaced by a more limited Sales and Services Levy a sales tax. Goods and Services are currently taxed at a GST Rate of 6. The price drops from RM2881 up to RM27672 for different models.

The implementation of GST system that has two rates of GST 6 and 0 and provides for the zero-rating of exported goods international services basic food items and many booksAs a broad based tax GST is a consumption tax applied at each stage. THE BUSINESS TIMES Malaysia GST - Find Malaysia GST News Headlines insight and analysis in Singapore Asia-Pacific global markets news at The Business Times. Ducati Malaysia has officially announced their latest price list with 0 GST for all of their current models.

The Royal Malaysian Customs Department RMCD has already commenced GST closure audits even arranging for tax professionals to conduct some audits for and on their behalf. What is GST rate in Malaysia. MT Webmaster Feb 7 2020.

The Goods and Services Tax is an abolished value-added tax in Malaysia. Additional penalty of 10 on the amount of GST due. Both GST vs SST with these single stage taxes were abolished when Malaysias GST was introduced.

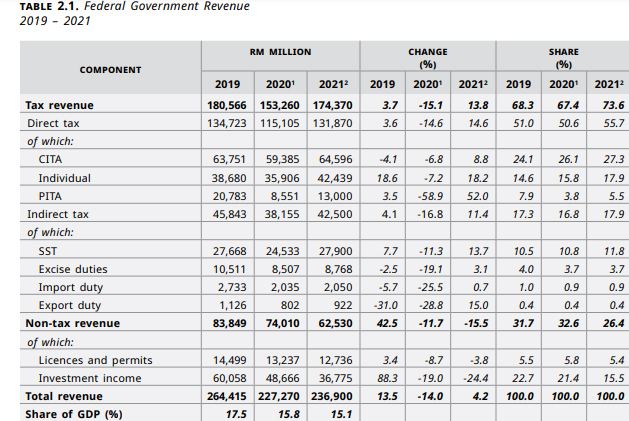

Therefore government revenue in 2018 is estimated at about 42 billion Malaysian ringgits 10 billion if the GST continues but having the SST back in.

No Gst Price Remains Good News All Leagoo Malaysia Absorp Gst Charge For Models Stated Below Lead 2s Rm499 Lead 7 School Logos Cal Logo Logos

Gst In Malaysia Will It Return After Being Abolished In 2018

Komentar

Posting Komentar